New tariffs on goods from various countries are now in effect for the United States. Incremental tariffs on products from other major trading partners have also been instituted. This tariff war is currently rattling some of the world’s top economies.

These regions, particularly those heavily involved in the electronics industry, are significant trading partners for the U.S. A substantial portion of the content that goes into electronics end-products passes through these countries at some point during manufacturing.

New Tariffs and Current Restrictions

As of March 24, an incremental 10% tariff on Chinese goods has already been instated. Despite the geopolitical landscape and regulatory uncertainty, China will likely remain a significant player in the industry. Procurement decisions that involve moving manufacturing and partnerships to other geographies to avoid higher costs will be time-consuming – they can’t happen overnight.

Rising raw material costs and increased tariffs on Chinese imports are driving up prices across the electronics and renewable energy sectors. The U.S. relies heavily on China for rare earth elements like helium and neodymium dysprosium, which are essential for electric vehicle motors and wind turbines, as well as indium, which significantly raises the cost of LCDs and solar panels. Additionally, tariffs on Chinese-made electronic components – such as printed circuit boards (PCBs), semiconductors, capacitors, and resistors – are expected to lead to higher prices for manufacturers and customers.

Companies that depend on Chinese-made passive components, including resistors and capacitors, may struggle to find alternative suppliers, forcing them to absorb or pass on higher costs. While some high-end integrated circuits (ICs) and field-programmable gate arrays (FPGAs) can be sourced from Taiwan, South Korea, or even the U.S., certain specialized components remain difficult to procure outside of China, leaving businesses with few options but to pay increased prices.

For example, a Chinese-made capacitor that cost $1 before tariffs may now cost $1.25 (if a 25% tariff applies). If distributors pass the full tariff to customers, the final price increases accordingly, leading to an overall increase in prices for electronic products.

Supply Chain Disruptions – A Potential Shift for U.S.-Based Manufacturers

If tariffs cause Chinese-made passive components (resistors, capacitors, etc.) to become too expensive, some U.S.-based electronic component manufacturers may move production to other countries (e.g., Vietnam, Japan, Taiwan, or India) to avoid tariffs. The new administration’s trade policies could further complicate these shifts, introducing additional tariffs on imports from countries like China. However, they may struggle to find alternative suppliers for certain components, especially if China dominates production. Some companies may push for domestic sourcing based on the incentives provided under the CHIPS Act, but this could be expensive due to higher U.S. labor and production costs. Preparing for these potential tariffs will be part of a successful strategy for U.S.-based manufacturers.

Supply Chain Adjustments and Alternative Sourcing for Distributors

Many U.S. companies are exploring alternative sourcing to avoid higher costs. First, they must identify if a part is sole- or multi-sourced. If a part is sole-sourced, distributors may source equivalent components from Taiwan, Japan, or other regions to avoid Chinese tariffs. If a part is multi-sourced, distributors may source the component from countries other than China.

Balancing delivery speed with cost is crucial for maintaining operational efficiency in shifting trade policies.

Some distributors may increase inventory of non-Chinese semiconductors and other electronic components to offer customers alternatives. Inventory from countries that aren’t subject to tariffs will likely be harder to find and procure as competition for those items increases.

Longer lead times and higher procurement costs could still affect availability and pricing. For example, new sourcing locations may not have the same infrastructure to move goods, which could push lead times for certain things from two weeks to eight to ten weeks – or more. Being prepared for these potential glitches will be part of a successful strategy.

Navigate New Tariffs on Electronic Components with Accuris Electronic Parts Solutions

For electronics manufacturers, navigating supply chain disruptions and tariff impacts is more challenging than ever. Accuris Electronic Parts Solutions is designed to empower every tier of the supply chain – from component manufacturers to distributors and end customers – by providing critical insights for cost-effective decision-making.

Staying informed about trade policy developments is crucial for businesses to adapt their strategies and mitigate risks.

Country/Region of Origin and Supply Chain Intelligence (SCI) data in Accuris Electronic Parts Solutions offer visibility into part sources – including those from China – helping businesses categorize components as high, medium, or low risk based on their impact on supply chains. U.S. tariff data, which will be incorporated in the Accuris solutions soon, will offer visibility into the tariff-impacted components.

For manufacturers and distributors facing the challenge of sole-sourced components from tariffed regions, Accuris Electronic Parts Solutions provides an effective workaround. The Close Alternates feature helps customers find the nearest substitutes outside of China, prioritizing performance, cost efficiency, lead times, and optimal quantity.

If a part is multi-sourced, users can identify alternative suppliers in non-tariffed countries, reducing procurement risks and ensuring supply continuity. By leveraging Pricing and Availability data, businesses can make informed choices to minimize additional costs and avoid delays.

Beyond supporting end customers, Accuris Electronic Parts Solutions delivers strategic insights for component manufacturers and distributors. The Supply Chain Intelligence database covers nearly 3,000 suppliers, including fabs, ATPs, and material suppliers, with key details such as manufacturing technology, wafer size, capacity, and cleanroom specifications. This data enables manufacturers to identify reliable alternative suppliers outside tariffed regions or within the U.S.

Distributors can assess sourcing risks, locate alternate components, and secure parts from non-tariffed sources. With its comprehensive capabilities, Accuris Electronic Parts Solutions is a useful tool for mitigating supply chain disruptions and optimizing procurement strategies. While this blog focuses on China, the same features apply to tariffs imposed on other countries, including Mexico and Canada.

Examples From the Accuris Parts Database

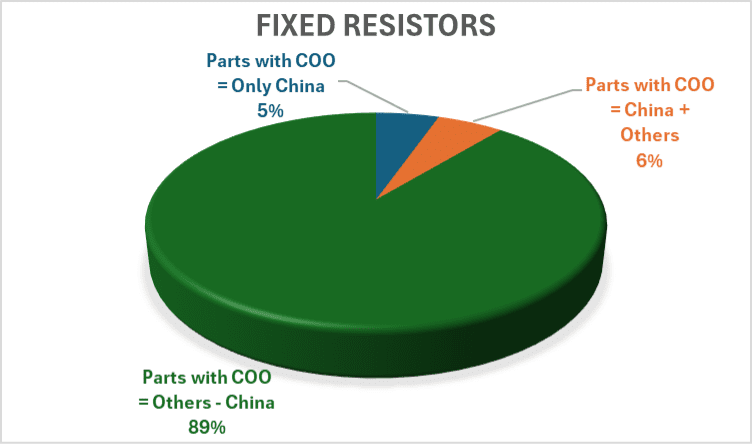

The snapshots below of the Fixed Resistors category shows a very promising and risk-free picture wherein the parts that are made only in China is a very small percentage.

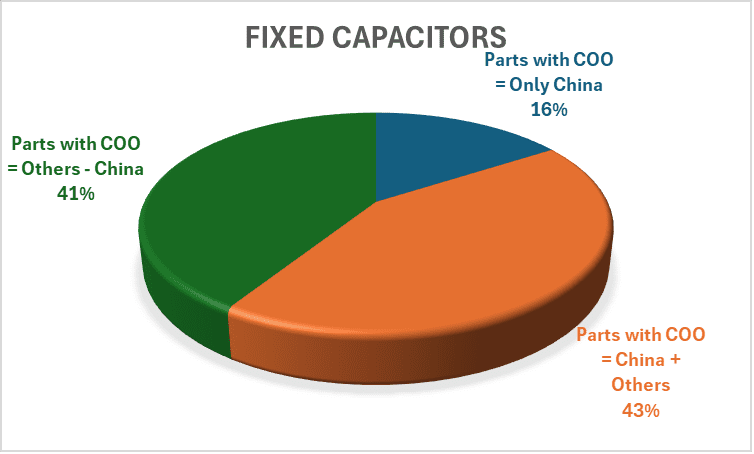

However, for Fixed Capacitors, the picture isn’t as rosy as it is for Fixed Resistors.